Sending money back home is more than a financial transaction for most people in the diaspora. It is a ritual of care, a quiet promise to support family across borders, and a lifeline that keeps households running thousands of kilometers away. Because of this emotional weight, choosing the right money transfer app becomes a serious decision, not a random download from the App or Google Play Store.

Among the dozens of platforms vying for attention, LemFi and TapTapSend have risen to the top as two of the most dominant services used by Africans abroad. Both apps promise quick transfers, low fees, and seamless delivery to banks and mobile wallets. Yet, anyone who has tried them knows the experience is not identical as each app has its strengths, quirks, and frustrations.

This article explores LemFi vs TapTapSend in a clear, honest, and deeply practical way. You will see how they differ in fees, speed, reliability, customer support, and overall user experience so you can choose the platform that truly matches your needs.

Company Backgrounds

To understand why LemFi and TapTapSend feel so different in your hands, you first need to appreciate the philosophies that built them. Both companies emerged from the same problem, the frustrating complexity of sending money across borders, but their journeys, motivations, and target communities diverge in meaningful ways.

LemFi: A Tech-Driven Challenger Built for Immigrants

LemFi, originally launched as Lemonade Finance, was created to solve a problem familiar to many young immigrants: sending money home quickly without drowning in fees or battling bureaucracy. The company positioned itself as a highly digital, high-velocity solution designed for the new generation of migrants who expect mobile-first services that run at the speed of their lifestyles.

Built by a team of African founders who personally understood the pain of international transfers, LemFi focuses heavily on speed, bold UX design, and aggressive exchange rates. Its branding speaks to younger users, international students, and tech-savvy workers who want frictionless global transactions without walking into a bank or filling endless forms.

In recent years, LemFi has expanded rapidly across the US, UK, Canada, and Europe, becoming a staple among African diaspora groups who appreciate its directness, polished app interface, and competitive fees.

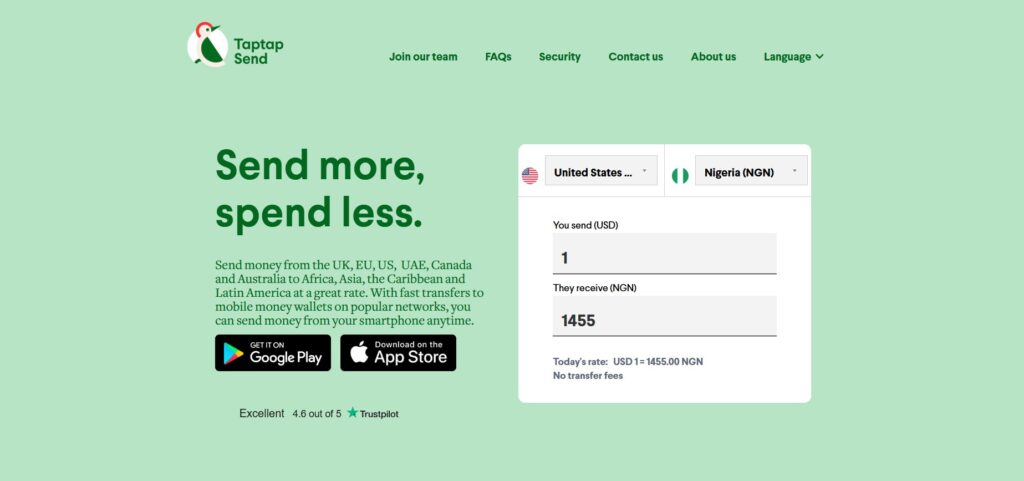

TapTapSend: A Community-Focused Remittance Service

TapTapSend takes a different route. Rather than presenting itself as a flashy fintech disruptor, it markets itself as a warm, community-rooted money transfer service built for stability and simplicity. It quietly inserts itself into diaspora communities through word of mouth, cultural events, ethnic grocery stores, churches, mosques, and long-established migrant circles.

Where LemFi feels modern and relentlessly tech-driven, TapTapSend feels calm and familiar. The company’s mission centers on helping people support their families back home as easily and affordably as possible, especially in regions where mobile money is dominant.

TapTapSend made its mark by partnering directly with mobile money operators across Africa and Asia, which gave it a huge advantage in countries like Ghana, Kenya, Cameroon, and Côte d’Ivoire, where many recipients rely on mobile wallets rather than traditional banks.

Transfer Fees and Exchange Rates

Money transfer apps live or die by the numbers. You can have the cleanest interface and the fastest onboarding, but if your fees and rates are bad, users will quietly abandon you. This is where LemFi and TapTapSend begin to diverge in noticeable, sometimes dramatic ways.

Before exploring how LemFi and TapTapSend structure their pricing, here is a quick snapshot of their actual fees:

Current Fee Snapshot (as of 2025)

(This table reflects publicly available information and typical pricing patterns across major remittance corridors.)

| Platform | Fee to African Corridors | Fee to Asian Corridors | Notes |

|---|---|---|---|

| LemFi | $0/£0 transfer fee for many African and EU destinations | Example: UK – Pakistan £0.99 | Exchange rate margin applies; often offers higher rates |

| TapTapSend | $0/£0 transfer fee for popular corridors like UK – Nigeria | Fees may apply depending on country | Usually embeds cost inside exchange rate margin |

LemFi

LemFi has built its reputation on consistently delivering some of the best exchange rates in the African remittance market. The platform often uses a lean, startup-friendly model that allows it to offer rates very close to mid-market prices. For users sending money regularly, even a tiny difference in the exchange rate can translate into thousands of naira, cedis, or shillings saved every month.

In many corridors, especially US or UK to Nigeria, LemFi has been known to outperform competitors by offering higher rates and lower margins. Add the fact that most transfers come with zero additional fees, and you understand why younger users flock to the platform. It feels like getting premium pricing without the usual remittance tax that other brands slip in quietly.

TapTapSend

TapTapSend’s fee structure is also attractive, especially for users who send smaller amounts frequently. In several countries, the app charges no explicit transfer fees, making it appealing to budget-conscious senders. However, TapTapSend often embeds its profit inside the exchange margin.

This means the rate you see may sit slightly lower than what LemFi offers for the same currency corridor. It is not a bad rate, but it mirrors the company’s conservative, stability-first approach. Their pricing is predictable, steady, and consistent, even if it is not always the highest available.

Where TapTapSend shines is mobile money payouts. In markets like Ghana, Kenya, or Senegal, the platform sometimes edges ahead with more favorable rates or zero-fee incentives tied to partnerships with local operators. This makes it a reliable choice for families who rely on mobile wallets instead of bank transfers.

For example, if you send the equivalent of $200 to a family member back in Nigeria on a good day, LemFi may offer a slightly higher naira rate, giving your recipient more value. TapTapSend on the other hand may deduct no fees but offer a sightly lower exchange rate, creating a more predictable but less optimized payout.

Speed and Transaction Reliability

In the remittance space, speed is not an optional perk. It often determines whether a utility gets paid on time or a family member has to wait anxiously. Both LemFi and TapTapSend promise fast settlement, but their real-world performance reveals subtle differences that matter more than people expect.

LemFi

LemFi is engineered for high-velocity transfers, especially along popular corridors like the UK, US, and Canada to West Africa. On a normal day, most transactions settle within seconds according to the company’s own documentation. On the other hand, independent reviewers and long-time users consistently report completion times of 3 to 5 minutes, even during moderately busy periods.

Although, when everything goes on smoothly as it should between LemFi, local banks, and money mobile operators, transfers hit recipient accounts almost instantly. This near-real-time experience is one of the platform’s biggest selling points.

In some cases, LemFi’s impressive speed can be affected by external factors ranging from Nigerian banks occasionally run slow verification checks, Ghanaian mobile money networks experiencing maintenance windows, to Kenyan operators having peak-hour congestion. In those moments, transfers that normally clear in under 5 minutes might stretch toward 10–20 minutes, or stall briefly in a “processing” state.

Refunds are generally quick, often happening in a few minutes, although delays may occur when the receiving institution takes longer to update LemFi’s system.

TapTapSend

TapTapSend also prides itself on speed, publicly stating that transfers complete “in minutes.” In practice, the platform tends to be slightly slower than LemFi on high-traffic African bank routes, but it makes up for this with remarkable consistency.

For mobile money corridors, Ghana, Kenya, Senegal, Cameroon, Uganda, TapTapSend often clears transactions in 5 to 10 minutes, maintaining a steady pace even during periods when other remittance services struggle. This consistency has earned TapTapSend deep trust among users whose families rely on mobile wallets for daily expenses.

Bank transfers in Nigeria may take longer, sometimes sitting in the 10 to 20-minute range when local banks introduce additional verification checks, although TapTapSend rarely crashes, freezes, or produces sudden spikes in delivery time.

In addition, refunds on TapTapSend are straightforward. If a transfer fails, reversals typically appear within a few minutes, unless the receiving partner’s system is slow to respond.

Ease of Use and App Experience

A money transfer app can offer the best rates in the world, but if the interface feels clumsy or confusing, people will abandon it without hesitation. Ease of use is where emotion meets functionality, and both LemFi and TapTapSend take noticeably different design approaches.

LemFi

LemFi approaches user experience the same way a modern startup would: bold colours, sharp transitions, and a layout built for speed over formality. From the moment you download the app, the onboarding process feels brisk. Verification is often completed in minutes, especially for users with valid ID documents from the US, UK, EU, or Canada.

The dashboard is intentionally bold and visually striking. Balances are displayed clearly, exchange rates update in real time, and initiating a transfer takes only a few taps. Features like multi-currency wallets, rate alerts, and in-app identity management appeal to younger users who want more than just a basic send-and-receive tool.

However, this fast-paced interface may feel slightly overwhelming for users who prefer simplicity. The app is designed with tech-savvy migrants in mind, and while it works beautifully for them, older users or first-time smartphone adopters might find the visual density too energetic.

TapTapSend

TapTapSend takes a completely different approach. Its interface is soft, friendly, and intentionally minimalistic. Instead of bold colours and aggressive design, you get a calm, uncluttered layout that prioritises peace of mind.

Onboarding is straightforward, and identity verification is smooth, though sometimes slower in regions with stricter compliance requirements. Once inside, the app guides you gently: large buttons, clear instructions, and a linear user flow that makes you feel like the app is holding your hand in the best possible way.

This simplicity is TapTapSend’s true strength. Users who want a quiet, predictable experience tend to love it. Elderly parents, less tech-inclined senders, or anyone who prefers a no-frills approach will find TapTapSend extremely comfortable.

Where TapTapSend falls short is flexibility. You do not get multi-currency wallets, rate alerts, or advanced user controls, instead the app prioritizes clarity over control, and while that makes it easy to use, power users may feel limited.

Countries Supported and Payout Channels

Where you live and where your family lives determine which app truly serves you best. Both LemFi and TapTapSend have expanded aggressively in recent years, but their footprints and payout systems are not identical. This is one of the most crucial sections for anyone comparing the two platforms, because availability can make or break your decision instantly.

LemFi

LemFi supports senders across major Western regions, including: United States, United Kingdom, Canada, European Union countries such as Ireland, Germany, Netherlands, France, Italy, Spain, Belgium, and Portugal

On the receiving side, LemFi channels money primarily into African destinations. Some of the most popular supported countries include: Nigeria, Ghana, Kenya, Uganda, Tanzania, Cameroon, Senegal, Rwanda, Ivory Coast, and Benin.

The platform prioritizes bank deposits, mobile money, and occasionally cash pickup depending on the region. What sets LemFi apart is its ability to deliver money into both traditional bank accounts and modern digital wallets with equal efficiency.

LemFi also offers multi-currency wallets for some senders, allowing them to hold USD, GBP, CAD, and EUR balances before sending. This appeals strongly to users who like monitoring exchange rates before committing.

TapTapSend

TapTapSend casts a slightly wider net when it comes to receiving countries, especially in regions where mobile money is the primary financial structure. The app supports a growing list of African and Asian destinations that rely on platforms like M-Pesa, MTN Mobile Money, Airtel Money, Orange Money, and Wave.

Popular receiving countries include: Ghana, Kenya, Senegal, Cameroon, Ivory Coast, DR Congo, Uganda, Zambia, Bangladesh, Pakistan, and Sri Lanka.

TapTapSend is particularly strong in Francophone Africa, where many competing platforms struggle with integration. The simplicity of sending directly into mobile wallets makes the app extremely appealing to families who depend on mobile money for daily transactions.

On the sender side, TapTapSend supports: United States, United Kingdom, European countries including France, Italy, Belgium, Spain, and the Netherlands, Canada in some corridors (still expanding)

Payout Channels: The Real Difference

This is where the distinction becomes very clear:

LemFi offers fast payouts to bank accounts and mobile money wallets, with a strong emphasis on traditional bank rails while TapTapSend excels in mobile money ecosystems, making it ideal for users whose families rely more on mobile wallets than bank accounts.

If your recipient prefers receiving money directly into a mobile wallet, TapTapSend may feel more seamless. On the other hand, if they prefer a bank account, LemFi often delivers faster and with better rates.

ALSO READ: Complete Guide to African Country Calling Codes (2025 Update)

Security, Compliance, and Trustworthiness

Money transfer apps handle some of the most sensitive data in your life: your identity documents, bank information, and the financial details of both you and your loved ones. Because of this, security is not something you judge lightly. It is the backbone of trust, and both LemFi and TapTapSend invest heavily in keeping users safe, though their approaches differ slightly.

LemFi

LemFi operates under a framework that mirrors high-level fintech standards. The company is registered and regulated in the regions it serves, and it relies on strict compliance protocols to keep both senders and recipients safe.

Key security pillars include:

- Licensed operations across the US, UK, EU, and Canada

- KYC verification using government-issued IDs, biometric checks, and document authenticity scans

- Two-factor authentication (2FA) during sensitive account actions

- Encrypted data transmission to protect card details, identity information, and transaction history

- Anti-fraud monitoring that flags unusual behaviour, suspicious login attempts, and rapid-fire transfers

LemFi’s security feels modern and proactive. The moment something looks unusual on your account, the system reacts instantly, sometimes even too aggressively, temporarily locking accounts for verification if activity seems abnormal. While occasionally inconvenient, this strict posture significantly reduces fraud potential.

TapTapSend

TapTapSend emphasizes stability as its security philosophy. The company is also regulated in every region where it operates, and its compliance culture is designed to be both transparent and predictable.

Core security features include:

- Full compliance with US, UK, EU, and Canadian regulatory bodies

- Standard KYC onboarding with ID verification and address checks

- Real-time fraud detection that tracks suspicious transfers and login anomalies

- Strong encryption protocols for financial and personal data

- Clear dispute and resolution processes, especially when dealing with mobile money networks

The platform has a reputation for taking fewer risks. TapTapSend rarely pushes your limits or approves transactions that appear even remotely suspicious. While this slower, more careful approach may frustrate users trying to send money urgently, it results in fewer fraud cases and more predictable account stability.

Customer Support

Customer support is beyond just an optional extra. When money is stuck, delayed, or misrouted, people panic, and rightly so. How an app responds in those critical moments determines its long-term reputation far more than marketing ever could. Both LemFi and TapTapSend have built recognizable support systems, but their styles and community feedback paint very different pictures.

LemFi

LemFi’s customer support is vibrant and energetic, mirroring the brand’s overall personality. Users can reach support through:

- In-app chat

- Email support

- Social media channels (X/Twitter, Instagram, Facebook)

During normal hours, response times can be surprisingly quick. Many users report getting replies within 5 to 15 minutes via the in-app chat when issues involve simple queries, verification questions, or routine transaction checks.

However, because LemFi serves massive, fast-growing diaspora groups, its support team can become overwhelmed during peak periods, especially holiday seasons, month-ends, and network outages in African banking systems. When this happens, some users experience delays ranging from 30 minutes to a few hours.

On platforms like Trustpilot and the Play Store, LemFi receives praise for:

- Fast transaction times

- Polite and helpful support agents

- Good problem resolution during typical scenarios

But it also receives criticism for:

- Occasional account freezes during aggressive fraud checks

- Delayed responses during peak hours

- The need for follow-up messages when banks delay settlement

Overall, LemFi’s support feels modern, responsive, and youthful, but not always consistent during heavy load.

TapTapSend

TapTapSend’s support system mirrors its overall brand philosophy: gentle, composed, and structured. Users can contact support via:

- In-app messaging

- ኢመይል

- Phone support in some regions

- A well-maintained Help Center

TapTapSend is known for maintaining a steady pace even when volume spikes. Response times are generally within 10 to 20 minutes, and during busy periods, delays rarely stretch as long as LemFi’s. What users appreciate most is the professional tone and the clear, step-by-step explanations agents provide.

On community platforms and app stores, TapTapSend receives praise for:

- Reliable customer service

- Clear communication

- Smooth dispute resolution

- Stable mobile money integrations

Criticisms mainly revolve around:

- Occasional long verification checks for new users

- Slow resolution when the issue originates from mobile money partners

- A slightly slower first response compared to LemFi’s fastest hours

What makes TapTapSend stand out is its ability to keep frustration low. Even when users are worried, the tone of the support staff tends to calm situations rather than intensify them.

Pros and Cons of Each App

By this point, the differences between LemFi and TapTapSend should be clear. But to make the comparison instantly digestible, it helps to break everything down into clean advantages and disadvantages. These summaries give you a quick snapshot of what each app excels at and where each one struggles.

LemFi: Pros and Cons

Pros

- One of the fastest money transfer apps available

- Extremely competitive exchange rates

- Zero transfer fees for most African corridors

- Modern, feature-rich user experience

- Strong African focus

Cons

- Support can be inconsistent during high-traffic periods

- Occasional account verification lockouts

- Not as strong in mobile money-dominant regions outside West/East Africa

- Limited Asian corridors

TapTapSend: Pros and Cons

Pros

- Exceptionally stable and predictable transfers

- Strong mobile money integrations

- Zero-fee transfers for many countries

- Calm, friendly, and highly professional customer support

- Broad coverage in Francophone Africa and South Asia

Cons

- Exchange rates are often weaker than LemFi’s

- App experience is simpler but less powerful

- Verification can be slow for some users

- Slightly slower than LemFi in peak African bank corridors

Verdict: Which App Should You Choose?

Choosing between LemFi and TapTapSend is not simply a matter of comparing numbers. It comes down to the kind of sender you are, the financial habits of your family back home, and the experience you personally value. Both platforms excel in different areas, and the best choice depends entirely on your priorities.

If you prioritize speed and maximum value, choose LemFi. LemFi is built for the user who wants immediacy, strong rates, and a modern fintech experience. It excels in situations where:

- You want the fastest delivery possible

- Your recipient prefers bank deposits

- You want the best exchange rate consistently

- You appreciate sleek interfaces and advanced features

- You send money regularly to Nigeria, Ghana, Kenya, Cameroon, or Uganda

- You want zero fees on major African corridors

- For the digitally-savvy diaspora user who prefers power, flexibility, and value, LemFi feels like the natural first choice.

If you prioritize stability, simplicity, and mobile money, choose TapTapSend. TapTapSend shines for users who care more about predictability than cutting-edge speed. It is ideal when:

- Your recipient relies heavily on mobile money wallets

- You want a calm, straightforward app experience

- You value steady delivery even during peak seasons

- You send to Francophone Africa or South Asian countries where TapTapSend has strong partnerships

- You prefer clean navigation without advanced options

- You want fee-free transfers and don’t mind slightly lower exchange rates

- For families who depend on mobile wallets and users who prefer a gentler interface, TapTapSend is the more dependable companion.

So which is better overall?

There is no universal winner. Instead, there are two champions for two different kinds of people. Interestingly, in reality, many experienced diaspora members use both apps. They switch depending on which platform has the better rate that day, which payout channel their family prefers, and how urgently they need the funds delivered.

This flexibility we get to choose between multiple platforms is the true advantage of modern remittance technology today.

Frequently Asked Questions (FAQs)

Which money transfer app is better, LemFi or TapTapSend?

Both money transfer apps are reliable, but LemFi is better for faster transfers and higher exchange rates, while TapTapSend is better for stability and mobile money payouts. Your choice depends on your needs.

Is LemFi safe to use?

Yes. LemFi is fully regulated in the US, UK, EU, and Canada. It uses strict KYC verification, encryption, and real-time fraud monitoring to protect your account and transactions.

How fast are LemFi transfers?

Most LemFi transfers process within seconds or in 3 to 5 minutes. During peak periods, transfers may take up to 10 to 20 minutes depending on local bank or mobile money network conditions.

Does TapTapSend charge fees?

TapTapSend usually charges no upfront transfer fee, but earns revenue through the exchange rate margin. Some corridors may have minor fees based on local regulations.

Which app has better exchange rates, LemFi or TapTapSend?

LemFi generally offers higher exchange rates across major African corridors, making it better for senders who want maximum value. TapTapSend offers steady but more conservative rates.

Does LemFi charge transfer fees?

LemFi charges $0 or £0 transfer fees for most African corridors. Some Asian corridors, like Pakistan or India, may have a small fee (for example £0.99 from the UK to Pakistan).

Which app is better for mobile money transfers?

TapTapSend is better for mobile money transfers, especially in Ghana, Kenya, Senegal, Cameroon, Uganda, and Côte d’Ivoire.

Can I use both LemFi and TapTapSend?

Yes, you can use both LemFi and TapTapSend. Many users switch between both apps depending on the rate of the day, the payout method, and how urgent the transfer is.

Does LemFi have transfer limits?

Yes, LemFi has transaction limits. The exact amounts vary by your account’s verification status, the sending-country and receiving-country corridor, and whether the payment is a transfer, wallet deposit, or card spend.

Final Thoughts

LemFi and TapTapSend have become essential tools for millions of people in the diaspora, each solving the challenge of sending money home in its own unique way. LemFi stands out with its speed, competitive rates, and modern fintech experience, while TapTapSend wins hearts with its stability, simplicity, and exceptional mobile money coverage.

The best choice depends entirely on your needs. Some users prioritise faster bank transfers and better rates, while others value predictable delivery to mobile wallets. In reality, the smartest approach is often to keep both apps installed and choose whichever offers the best rate and payout method on the day you need it.

At the end of the day, the goal is the same: ensuring your family back home receives money quickly, safely, and affordably, and both LemFi and TapTapSend excel at that mission.